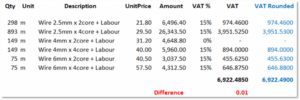

We are sometimes asked “How is VAT Calculated on Eazy Costing Invoices?” The reason for the question is because sometimes the VAT Calculated doesn’t = (Sub-Total + Sub-Total x VAT Rate).

The reason for the seemingly incorrect value is because Eazy Costing uses International Financial Reporting Standards (IFRS) guidance to calculate VAT. These standards dictate that VAT needs to be Calculated and “Rounded” to two decimal places on each Invoice Row and then totaled for the Invoice; the reason for VAT being calculated on each row is because not all rows will necessarily have the same VAT Rate so calculating it “at the end” will have the incorrect value if there are different VAT Rates in different Invoice Rows.

Excel Example of the VAT Calculations